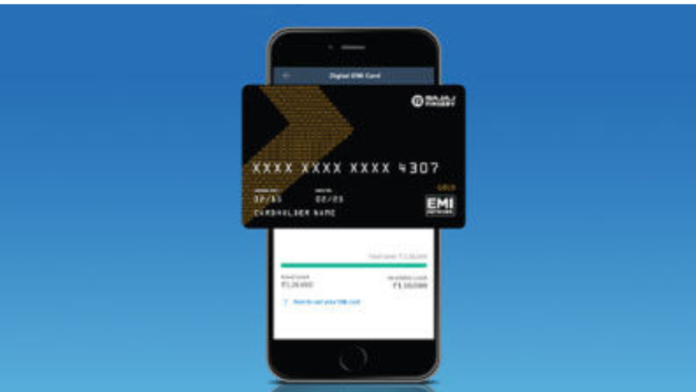

You can buy your favorite things with the Bajaj Finserv Insta EMI Card on simple EMIs and pay them monthly. You can also receive a pre-approved loan of up to Rs. 2 lakh and buy expensive things on free EMIs. You must be between the ages of 21 and 65 and have a stable source of income in order to apply for a new Insta EMI Card. For new consumers, applying for the Bajaj Finserv Insta EMI Card is reasonably easy and uncomplicated.

This card offers a wide range of features and advantages, such as an instant pre-approval credit limit of up to 2 lakh, no cancellation fees, no documentation requirements, no loan foreclosure fees, simple repayment options, free EMIs, seamless use at partner establishments, and simple tracking of all transactions, loans, and repayments through My Account, the customer portal, or the Bajaj Markets App.

Top 3 useful features of the EMI Network Card

Easy Online & Offline Shopping

Use the Insta EMI Card to purchase at partner retailers like Vijay Sales, Croma, Reliance Digital, and others for your favorite electronics and gadgets. Additionally, you may buy items from lifestyle partners on EMI, including furniture, exercise gear, professional courses, and much more. Shop for the newest electronics and items on the Bajaj Mall with the Insta EMI Card. Shop from home with no interest-free payments and additional perks like home delivery, no down payment, doorstep demos, etc. Additionally, you can shop on well-known e-commerce platforms like Amazon, Flipkart, MakeMyTrip, etc.

Pre-approved limit of up to Rs. 2 lakh and flexible tenures

Repaying for your purchase is simple with the Bajaj Finserv Insta EMI Card thanks to its versatile tenure options, which range from 3 to 24 months. Take advantage of a card limit of up to Rs. 2 lakh with the Bajaj Finserv Insta EMI Card. The Insta EMI Card comes with a pre-approved loan of 2 lakh and may be used to make EMI payments for items from partner businesses both online and off. There is no modest down payment, foreclosure fees, or flexible payback period.

Minimal documentation and easy access with a 100% digital process

To apply for a Bajaj Finserv Insta EMI Card, present a few primary documents when you make your first transaction at partner retailers. You do not need to provide documentation to obtain an Insta EMI Card. An Insta EMI Card can be obtained using a 100% digital process in 3 simple steps. Not only that, but your card is instantaneously active. The Bajaj Finserv app lets you access your EMI Network Card. If you foreclose on your loan after making your first EMI, there won’t be any fees.

Top 3 Useful Benefits of Bajaj Finserv EMI Network Card

There are numerous benefits of the Insta EMI Card and one of them is that you can make hassle-free and satisfying purchases thanks to several appealing features. You receive a pre-approved loan on the card in addition to the option to pay in Equated monthly installments (EMIs) without paying any additional fees or facing foreclosure penalties. In order to meet the various needs of consumers, payback terms are also created. Here is all the information you require regarding the features of the Insta EMI Card that make it a convenient means of payment.

The top 3 Useful Benefits of the Insta EMI Card

Shop on EMI without a credit card

The Bajaj Finserv Insta EMI Card is a unique Insta EMI Card that functions as a pre-approved loan and assists you in converting the cost of purchasing electronics, appliances, and other items into a simple, affordable EMI. Purchases made at Bajaj Finserv partner stores like Amazon, Flipkart, Oppo, OnePlus, Pepperfry, etc., can be made securely. All you have to do is choose an appropriate tenure for your EMI payment and use the Insta EMI Card as your preferred means of payment at the payment gateway.

Cardless shopping at partner stores

Using your EMI Network Card, purchase items such as mobile phones, laptops, furniture, and other items on EMI from any of the 1.2 lakh offline partner retailers distributed over 2.900+ cities. With Bajaj Finserv’s cardless EMI option, you can shop at partner retailers even if you do not have your Insta EMI Card.

Feature of Wallet app

Your Insta EMI Card may be readily accessed on the Bajaj Finserv app or managed online through the customer portal, so you do not need to carry it around with you everywhere. To validate your transaction and allow you to buy safely, the card sends an OTP to your RMN. You can choose from various household appliances, technology, and electronics for No Cost EMI, zero down payment, and 4-hour / same-day rapid delivery as part of the Insta EMI Card features. Apply for a Bajaj Finserv Insta EMI Card today to receive a host of advantages!

The Insta EMI Card application procedure is entirely digital, and the Bajaj Markets app makes it simple to access your active card. Without a credit card, you can shop on EMI at the online and physical partner retailers using the digital Bajaj Finserv Insta EMI Card. The Bajaj Markets app makes it simple to manage and access the card.

Also Read: Secured Loans vs. Unsecured Loans